Variable salary that fluctuates with the company's performance

I already mentioned that we do not work like most organizations. We are almost at the point where people decide their own salary (more on that topic in an upcoming post). Some are even contemplating making their salary public to everyone within the company (more on that also in an upcoming post). For now, I want to share some interesting discussion around what is called the “risk salary”.

Now that our leaders were happy with their salary – or at least responsible for them – Paulo had another, even more daring proposal, He called it “risk salary”.

“Each of you now has the correct salary, according to your own estimate of your worth,” he told managers at a meeting of company leaders in 1989. “I propose to pay you a little less, but in return will give you the possibility of earning more.”

Then he explained his new wrinkle. If Semco did well, an employee who agreed to risk a 25 percent salary cut – the limit – would receive up to 50 percent more. If Semco did poorly, he would suffer the 25 percent cut. So a manager who received, say, $1,000 a week could risk having it reduced to $750. On the other hand, he could, at the end of each quarter, get an amount that would bring his weekly salary to $1,500.

Maverick: The Success Story Behind the World’s Most Unusual Workplace

We are talking about implementing a similar concept. Below is how the proposed model would work.

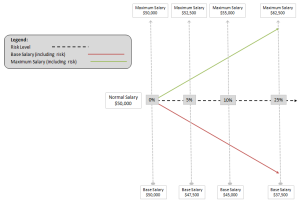

- The Normal Salary is the employee’s current salary. For the purpose of this example, it is set at $50 000.

- The Black Line in the middle of the triangle represents the level of tolerated risk. This level can be anywhere between 0% and 100% depending on the choice of each individual.

- The Red Line at the base of the triangle represents the base salary depending on the level of tolerated risk. For example, an amount is indicated for each level of tolerated risk – at a 5% risk level, the base salary is $47,500 while at a 25% risk level the base salary becomes $37,500.

- The Green Line at the top of the triangle represents the maximum salary level associated with the tolerated risk level. For example, an amount is indicated for each level of risk accepted - at a 5% risk level, the maximum salary is $52,500 while at a 25% risk level the maximum salary becomes $62,500.

- The bonus model is based on the “normal salary” and doesn’t include a risk factor.

- The bonus model is pretty much defined the same way for everyone in the organization while this model allows each individual to set their risk level.

- The bonus model may motivate employees to deliver better performance but it is considered a bonus on top of one’s salary. On the other hand, the risk model allows employees to set the level of risk that would motivate them to deliver better performance.

This model was used by a few employees last year and the discussions around opening this model to everyone are under ways. Interestingly enough, although this model would be entirely voluntary employees are divided on the implementation of this proposed model. I should be able to share more details on this experiment in the months to come.

Martin,

nothing makes me happier then seeing Semler’s ideas implemented. I’d love to hear how you’re doing with this.

I’ve actually founded a new payroll business is experimenting with several offerings. For example, putting retirement information or insurance cash balances on employee pay stubs. We are also experimenting with ideas similar to this risk model and offering the tracking and communication of these balances to employees on their pay stubs.

If you’re interested, I’d love to get your feedback on what we’re doing and to see if there are some other ideas which might be worth considering. Let me know and have a Merry Christmas,

Andy

ameyer32 (@) yahoo dot com

Thank you for your comment and the Xmas wishes Andrew. I’d certainly be interested in sharing perspectives on some of the things you are currently doing.

Merry Christmas to you as well. Hope to read more of your comments in the New Year!